The Baker McKenzie Cloud Compliance Center provides a snapshot of the legal and regulatory position of cloud in key jurisdictions of interest for financial institutions, and provide simple answers to a few important headline questions that all financial institutions will need to consider when taking the leap to cloud.

Technology in financial services is no longer limited to fintechs, but its adoption is a vital part of every financial institution’s business model in order to react to disruptive competitors, meet higher customer expectations (over accessibility, functionality and ease of use) and to reduce costs improving operational efficiency. In our 2021/2022 Digital Transformation and Cloud Survey, respondents from financial institutions note they see cloud computing as one of the most integral technologies in their digital transformation strategy.

Currently covering ten key jurisdictions, the Cloud Compliance Center covers the following topics:

- Permissibility of cloud

- Rules for cloud outsourcing

- Contract requirements

- Regulated cloud outsourcing

- Regulatory notifications

- Consequences of regulatory breach

- Data privacy and security

- Overseas hosting

- Financial services authorizations licenses

- Customer data subject consents

- Data access requirements

- Data disclosure requirements

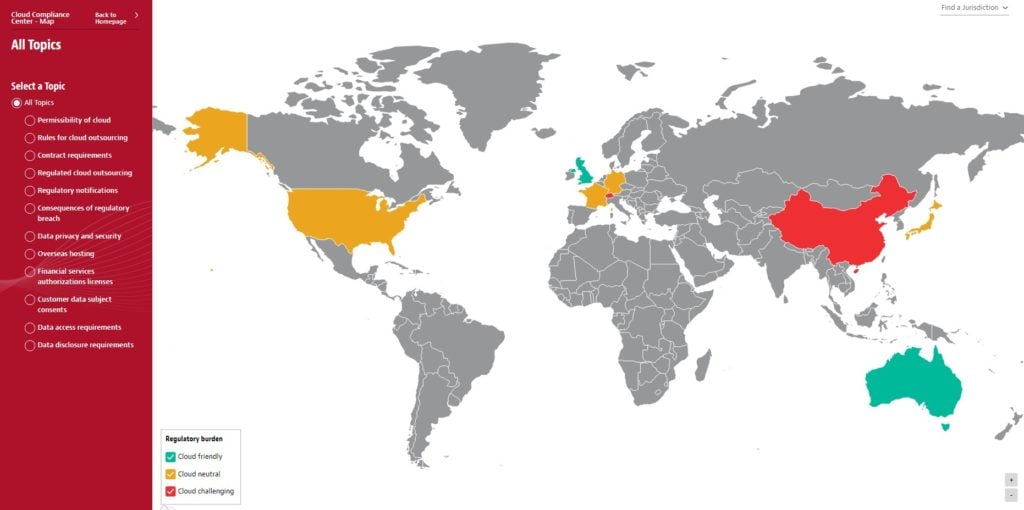

You can access the Cloud Compliance Center on Baker McKenzie’s Resource Hub. The resource has a comparison tool that allows users to compare differences among jurisdictions, and an interactive map tool that shows a heat map of the regulatory burden for each jurisdiction.