The starting point for understanding digital asset regulations in Thailand is the Emergency Decree on Digital Asset Businesses, B.E. 2561 (2018) – the Digital Assets Decree. This specifies a new asset class (digital assets) to be regulated under Thai law. From its effective date (14 May 2018), any business operator who wishes to conduct any activity regarding digital assets must take this law into account.

The digital assets industry in Thailand has been growing significantly between 2021 and 2022, as more big players in the traditional financial industry and startup players enter the digital assets market. Despite the price volatility and regulatory complexities, the country has seen a rise in crypto-related activities.

In this updated report – A Complete Guide to the Regulations on Cryptocurrency and Digital Token Offering in Thailand – the Baker McKenzie Thailand team provides an update of the regulations pertaining to digital assets in the country. The report covers regulations around custodial wallet providers, digital asset payments and NFTs. It also includes the SEC’s proposed rules on ready-to-use utility tokens, advertisements, and IT standards.

Here are some topics covered in-depth:

- Applicable laws governing cryptocurrencies and digital assets

- Digital asset laws

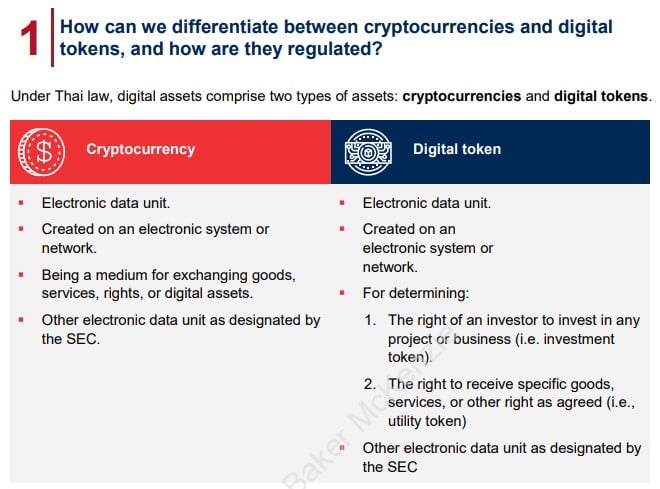

- Differentiating between cryptocurrencies and digital tokens, including how they are regulated

- Overview of the regulatory regime on the offering of digital tokens and operation of a digital asset business

- Guidelines for various types of market participants

- Anti-money laundering (AML) regulations

- On-boarding process

- Ongoing compliance requirements

In late 2021 until mid-2022, the Office of the Securities and Exchange Commission (SEC) continually held public hearings, and issued additional guidelines and regulations. The licensing procedure is stringent since the SEC intends to provide a strong risk governance and safe environment for investors. The SEC has also strictly enforced the rules by prosecuting and fining the non-compliant business operators.

Cryptocurrencies and digital assets continue to evolve. With that evolution comes stringent regulations to protect all stakeholders in the value chain.