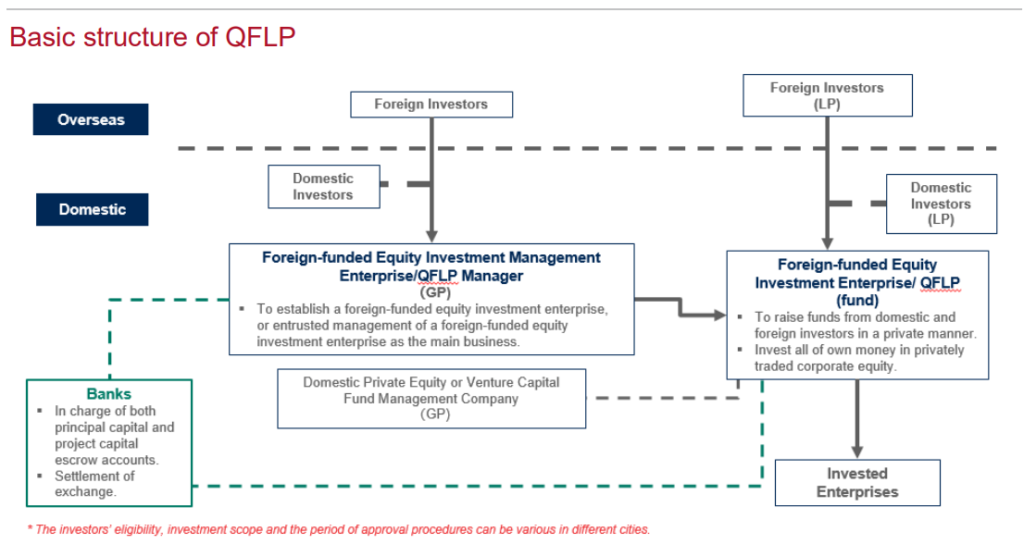

The Qualified Foreign Limited Partnership (QFLP) is a pilot program developed by various local authorities serving as an essential channel for foreign investors to invest in China’s financial market. Under QFLP, foreign investors are able to participate in the establishment of a foreign-funded equity investment management enterprise (QFLP Manager) or a foreign-funded equity investment enterprise (QFLP Fund). For context, QFLP Manager and QFLP Fund are collectively referred to as QFLP Enterprises.

QFLP stipulates that foreign exchange funds can be settled in RMB at the fund level and make equity investment in RMB. In other words, foreign exchange settlement will be approved in advance at the time when a QFLP enterprise is set up, instead of when the capital is called.

Here are other key takeaways from the alert:

- Foreign investors who participate in the investment and establishment of domestic QFLP enterprises shall also pay attention to the restrictions of laws and regulations of their own jurisdictions, and remain subject to specific industry rules.

- There are some key elements of QFLP – which covers important aspects. Here are some examples, with specific regional differences. The more detailed guidelines related to the supervision system, QFLP Managers, QFLP Funds, and other focused matters can be found in the full alert.

- In terms of the supervision system, most regions such as Beijing, Shanghai and Shenzhen establish a joint review mechanism involving all competent departments to review and grant the qualification of QFLP Enterprise with the local financial regulatory bureau generally being designated as the main contact department. In a few regions such as Hainan and Guangzhou, instead of implementing a specified joint review mechanism, the qualification process only stipulates that the relevant departments are responsible according to the division of their responsibilities.

- The threshold requirements for QFLP Managers vary from place to place. For example, Beijing requires the manager shareholders, actual controllers and executive partners to be financial enterprises or foreign currency fund management enterprises with a management fund scale of not less than RMB 100 million or equivalent foreign currency. However, there are also regions that do not specifically set the threshold in their QFLP policies, such as Hainan and Guangzhou. Therefore, the investors are advised to consult the local competent authorities on a case by case basis before going through the process of actual application.

- The threshold requirements for investors of QFLP Funds vary from place to place. For example, Beijing puts forward specific requirements for foreign investors’ investment experience, internal control system and asset amount, while Zhuhai puts forward preferential policies for Hong Kong and Macao investors, such as lowering the threshold for a subscribed capital contribution. In addition, most pilots do not specify requirements for domestic investors, and even some pilots such as Shenzhen, Guangzhou and Hainan seem not to set specific thresholds for either foreign or domestic investors in their QFLP policies, so the investors are suggested to consult with local authorities for more detailed information in advance.

- Requirements on other focused matters are also distinct. In terms of tax policy, most regions such as Shanghai and Shenzhen have no specific regulations on tax; while a few regions such as Guangzhou specify detailed provisions and give some preferential tax policies. Therefore, the investors are also suggested to further consult with the local competent authority and confirm their policy position regarding tax.

QFLP policies in various regions are also constantly adjusted and optimized – from the initial specific provisions and control provisions to the gradual relaxation and even the gradual convergence of domestic and foreign capital management. It is necessary to keep monitoring these developments.

You can read the full alert – An overview of the QFLP pilot program and expectation – on Baker McKenzie’s InsightPlus.