Our new Asia Pacific DealSCAPE reports analyze the role of transactions for companies transitioning into their respective renew and reinvent phases. Baker McKenzie experts examine different industry trends, providing their take on corresponding opportunities and legal considerations.

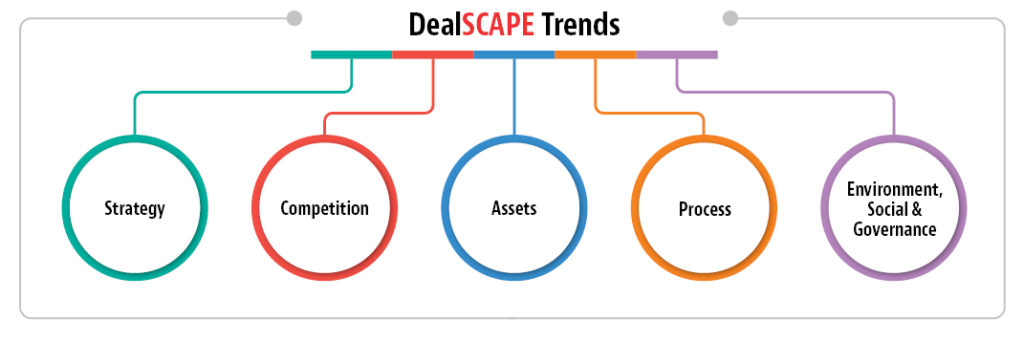

We explore the defining characteristics of transactions, using the SCAPE framework to understand legal complexity and stress test plans in an evolving landscape. We cover three sectors in this series: (1) Automotive, (2) Aviation, and; (3) Luxury, Fashion and Retail.

Applying the framework, these are some of the major takeaways from the reports:

- Cash-rich conglomerates, highly capitalized groups and private equity will drive deal activity fo the most desirable assets in Luxury, Fashion and Retail. This will also trigger further industry consolidation with a particular interest in smaller, new names and brands that resonate with a growing class of younger consumers.

- The influx of private capital in the automotive industry is driving up prices, making acquiring acquisition-ready assets more risky and expensive. Desirable assets are likely to be development-stage development-stage technology companies looking for fast capital to fund development and scale operations.

- Aviation businesses are likely to require funds in addition to the finance secured from governments and bond markets. The pandemic forced a majority of aviation businesses to prioritize financial resilience and flexibility to hold off insolvency. Capital will have to come from equity, with balance sheets and credit lines already maxed out. In light of overcapacity, rationalization will provide the opportunity to raise funds via divestments.

- Cash flow remains an issue for Luxury, Fashion and Retail, particularly for those that were running large inventories before the pandemic. Careful due diligence is required early on in the process and up to the time of acquisition to assess the risks with pursuing the transaction in view of country specific insolvency processes and stipulations which may automatically apply in certain circumstances.

Financial institutions have important roles to play in these transactions as financiers or financial advisors whether they involve private M&A transactions, or in public M&A transactions like take-privates. From an investor standpoint, there are opportunities for private equity, sovereign wealth funds, pension funds, and family offices to provide capital in the form of equity or through private credit to fund digital transformation projects and other initiatives.

Each report outlines areas of the transactional DealSCAPE, highlighting key sub-sector trends, opportunities for strategic growth and specific areas of legal consideration to renew and reinvent. You can read the full reports: Asia Pacific DealSCAPE on BakerMcKenzie.com.