On 12 November 2020, Ukrainian Parliament registered a draft payment services law (available here in Ukrainian). This milestone work was coordinated by the Ukrainian central bank (“NBU“) with the aim to fully replace the existing regulatory framework for the payments business in Ukraine. As reported earlier, very broadly, it seeks (i) to remove certain regulatory barriers to entry to the payments market and (ii) implement certain EU laws applicable to payment services, such as Directive 2015/2366 (PSD2) and Directive 2009/110/EC (Second E-Money Directive).

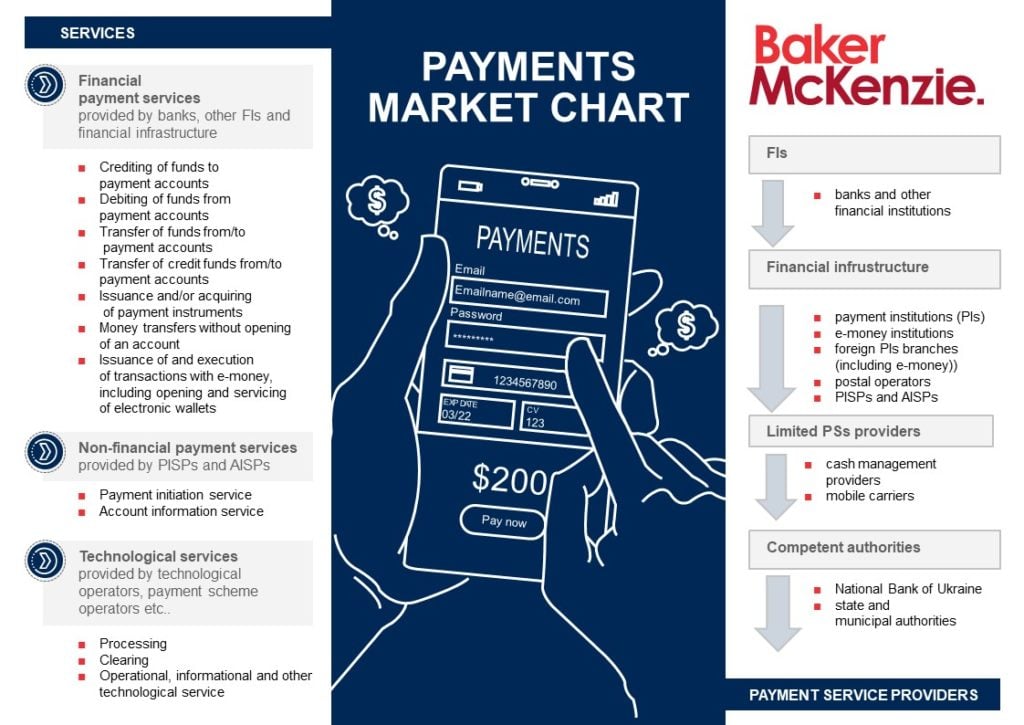

Architecture of the payments market

As you can see from the chart, the draft law primarily replicates the PSD2 model in terms of the regulated services that will become available in Ukraine. Moreover, it contemplates regulating a number of ancillary services. Some of these, such as services of a payment scheme operator and technological operator, are not new: one may argue that these are subject to regulation under the existing regime, albeit under different naming conventions.

A curious feature of the draft law is a separate regulatory regime for so-called “limited” payment services. These can be rendered by (i) a cash management company and/or (ii) a mobile carrier, which processes payment transactions of its customers relating to purchase of mobile content, e-tickets, as well as some other use cases. The latter may constitute a derogation from the PSD2 model, which provides for an electronic communications exclusion (unless the value of the transactions processed by the mobile carrier exceeds the contemplated threshold). The draft law seems to take a different route because its default provision regards such an activity as a provision of the “limited” payment service subject to authorization of the NBU (as far as we are aware from the market, the local mobile carriers industry also acknowledged this striking difference and is discussing this peculiar feature with the NBU).

In line with PSD2 model, the draft law prohibits both payment institutions and e-money institutions from engaging (in addition to rendering financial payment services) in other activities except for:

- ancillary services

- limited payment services

- FX transactions pertaining to the payment services

- other financial services in cases envisaged under legislation

- other activities envisaged under applicable legislation

The draft law also provides for a list of exclusions, i.e., types of activities that fall outside of its scope. Again, this list primarily follows the PSD2 model. The notable distinction is mentioned above concerning mobile carriers handling payments: the draft only excludes payments collected by mobile carriers in the context of a charitable activity.

Old or new payments market players?

Very broadly, all payments market participants may be allocated into four separate groups. The usual suspects are banks (which may provide any payment service based on their banking license) and other financial institutions (e.g., insurance companies), which are entitled to provide money remittance and acquiring services subject to conditions envisaged under the general financial services legal framework. The second largest group comprises various financial infrastructure entities, such as payment and e-money institutions, postal operators and providers of non-financial payment services. All of these also seem to exist in the Ukrainian market now, albeit sometimes under different names and with different capacity. The third group is composed of the regulator and competent authorities. The last group is composed of providers of limited payment services.

Again, the above structure is broadly based on PSD2 model. In particular, in line with Article 32 of PSD2, the draft law provides for a separate “small payment institutions” regime, which will be able to obtain a payments license provided the total value of executed payment transactions does not exceed a limit to be set by the NBU. As mentioned above, a peculiar feature of the draft law is that it distinguishes so-called providers of “limited payment services,” which don’t seem to be envisaged under PSD2.

Would a non-Ukrainian service provider need to comply with the authorization requirements?

Very broadly, the draft law follows the PSD2 model in the sense that it applies to “one leg” transactions, i.e., those that are either initiated or received in Ukraine. This implies that in order to evaluate whether any type of activity could be caught under the new regime, a foreign PSP may need to carry out an impact assessment regarding its exposure to a transaction that may qualify as having been “carried out in Ukraine,” which does not seem like an easy task in the globalized e-commerce world.

A notable difference of the draft law in comparison to the current regime is that it provides for an exhaustive list of entities eligible to render payment services in Ukraine. The list includes a branch of a foreign payment institution (such definition also includes foreign e-money institutions).

On its face, it may not seem like something to be worried about, unless a foreign PSP intends to set up a branch in Ukraine. However, this provision has to be analyzed in the context of the broader financial services reforms currently being carried out by the NBU. Thus, the draft financial services law (available here in Ukrainian) indicates that a foreign financial service provider (including a PSP) may render its services in Ukraine pursuant to the requirements of the applicable specialized law. In our context, this means that the applicable regime must be spelled out in the payment services law.

The draft law currently provides only the following provision: “Foreign payment institutions may set up a branch in Ukraine and carry out their activity through them in Ukraine.”From an international trade perspective, this refers to the third mode of supply, i.e., a commercial presence in the jurisdiction. Therefore, both the list of suppliers and the above provision do not seem to address an alternative “cross-border” mode of supply (i.e., without a physical presence in the jurisdiction), which seems to be more appropriate in many use cases. Given this, it appears that the draft law may need to be clarified in this respect, i.e, to clarify the requirements applicable to the “cross-border” mode of supply.

Likewise, the draft law is not entirely clear in terms of regulatory regime for foreign “technological operators”. It does not seem to be expressly spelled out, but one may read among the lines that such services may be offered cross-border subject to registration by the NBU (except that foreign technological operator may not be eligible to offer its services to a local e-money institution).

What about “passporting” payment services by the EU-based PSPs into Ukraine?

It is envisaged under the EU Ukraine Association Agreement that as soon as Ukraine implements a number of EU financial services acquis communautaire, it will become eligible for access to the EU internal market for financial services. In practice, this implies that both the EU and Ukraine may potentially achieve an “unprecedented level of integration” whereby both EU and Ukrainian PSPs could “passport” their services in Ukraine and EU markets accordingly. This innovative market access regime is, however, subject to a very strict conditionality procedure. Given the current pace of European integration activities carried out by the Ukrainian government, this is not likely to happen in the near future. In case you are interested in more detailed assessment of the European integration process, feel free to check out the reports prepared by the Ukrainian Government (available in English here).