The advent of cryptocurrencies and Initial Coin Offerings (ICOs) around the world has resulted in a broad set of how different jurisdictions handle these industries. The Complete Guide to Regulations on Cryptocurrencies and ICOs in Thailand aims to depict the regulatory landscape of digital assets in Thailand based on prevailing regulations as of 14 September 2018.

With this guide, you can expect to learn:

- how to differentiate between cryptocurrencies and digital tokens and how these items are regulated

- insights into Thailand’s regulatory regime on cryptocurrencies and ICOs

- how you fit into this new regulatory landscape and its implications for you

- likely developments based on considerations that the Securities and Exchange Commission (SEC), Thailand’s main regulator for the Digital Asset Business Decree, are weighing

- the tax implications for digital asset businesses and the ICO industry

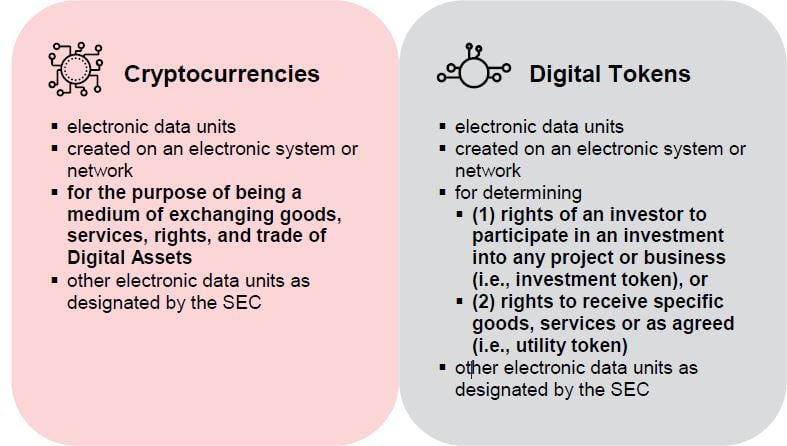

The key difference between these two types of assets is that Cryptocurrencies are created in order to serve a particular purpose as a medium for exchange, which might be exchange for goods, services or other rights, or to be used as consideration for trading with other Digital Assets. On the other hand, Digital Tokens are generated to be used as a determinant of rights, which could be rights as an investor or the right to receive specific goods or services.