Here’s a quick overview of how Digital Assets, which comprise of Cryptocurrencies and Digital Tokens (e.g. those raised through so-called ICOs or token crowd sales), are to be regulated and taxed in Thailand. A complete summary is available here: Client Alert.

Cryptocurrencies vs. Digital Tokens

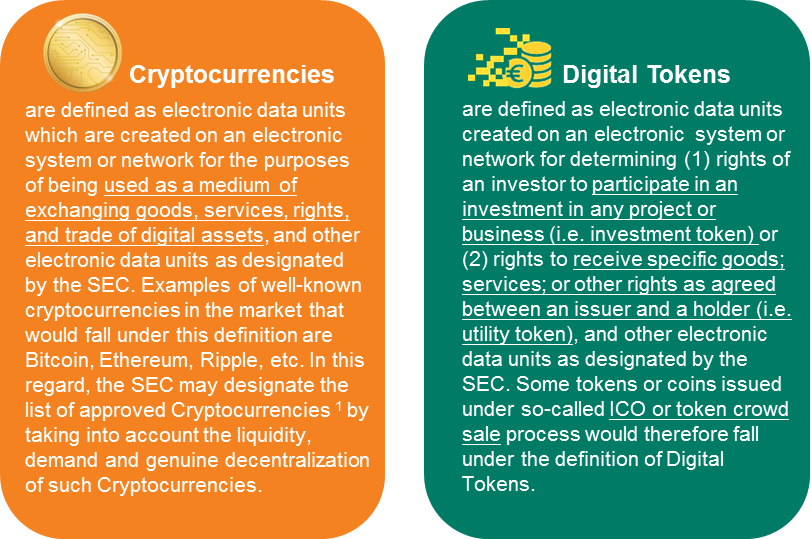

Digital Assets comprise of two categories of assets, namely “Cryptocurrencies” and “Digital Tokens”.

Regulatory landscape

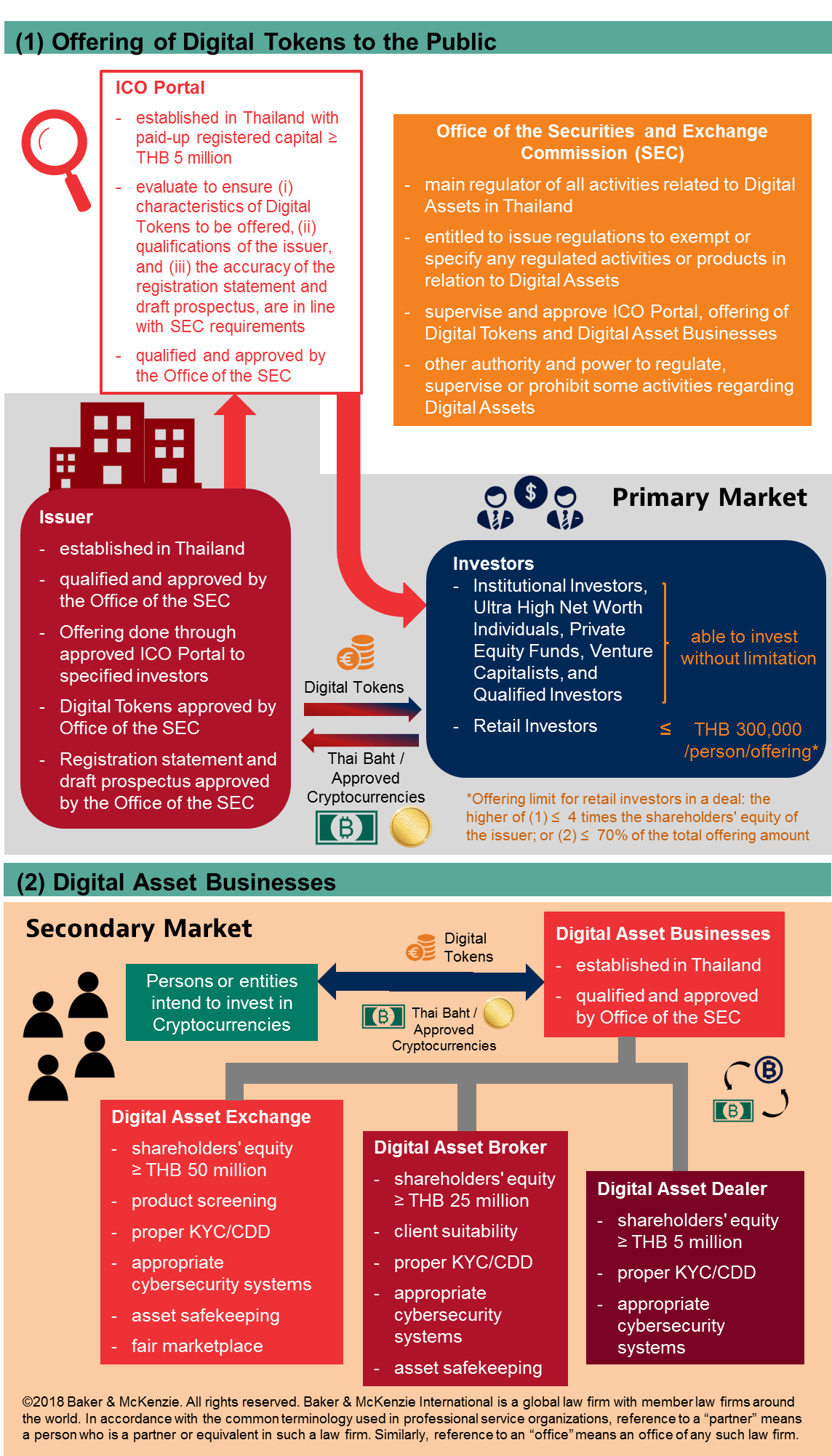

Regulated activities include (1) offering of Digital Tokens to the public and (2) operation of Digital Asset Businesses.

Tax Implications

The Amendment of the Revenue Code Decree amended the Revenue Code by adding new types of income and imposing withholding tax obligation with regards to Cryptocurrencies and Digital Tokens.

A share of profit or any benefit derived from holding or having possession of Digital Tokens is regarded as taxable income under Section 40(4)(h) of the Revenue Code and capital gain from the transfer of Cryptocurrencies or of Digital Tokens is regarded as taxable income under Section 40(4)(i) of the Revenue Code.

Any individual (both Thai and non-Thai tax residents) who derives income as mentioned above will be subject to a withholding tax at the rate of 15 percent. It is important to note that the 15% withholding tax is not a final tax, which means that the individual recipients will still be required to include such income into their personal income tax return filing. Net income (i.e. taxable income less deductible expenses and allowances) is subject to personal income tax at progressive rates of 5% to 35%. The 15% withholding tax is creditable against the personal income tax payable.

However, an ICO issuer will be subject to both corporate income tax and VAT as a result of the ICO. This means that the ICO transaction, i.e., an ICO issuer issuing Digital Tokens in exchange for either cash or Cryptocurrencies from investors, would potentially trigger taxes on both ICO issuer and investors. Nevertheless, the tax regulation on Digital Assets may change in the near future to ease the tax liabilities on ICO issuers and to promote the Thai Digital Economy.