An interesting panel discussion on token distributions and regulation.

While an “ICO” (Initial Coin Offering) is a trending term at the moment, it must be used with caution so as not to be confused with an “IPO” (Initial Public Offering), i.e. an offering of securities to the public, which sounds similar. In this post, we refer to “token distributions” rather than ICOs. In reality, some types of token distributions are not distributions of securities at all. Token distributions are a way for startups focused on distributed ledgers (such as blockchain) and cryptographic or digital assets, to receive revenue or raise capital and engage with prospective users of their technology by distributing “tokens” based on a particular technology protocol – see an earlier blog post for a primer.

A large number of investors, not just from the VC community, are purchasing tokens. The Securities and Exchange Commission (SEC) recently issued an investigative report cautioning market participants that offers and sales of digital assets by “virtual” organisations may be subject to the requirements of U.S. federal securities laws. Other regulatory bodies around the world have followed and may follow suit: take a look at the recent regulatory guidance issued by the SEC in the USA, the MAS in Singapore (and our commentary), the CSA in Canada and most recently the SFC in Hong Kong. The People’s Bank of China has gone further, stating that all “ICOs” are “illegal” and refunds must be provided by those who have already raised money.

The focus of a recent panel discussion, “What is the ICO Craze All About?”, hosted by the Fintech Club in Hong Kong, was on whether token distributions are disruptive and revolutionary and how they could – and should – be regulated.

On the panel were Brendan Blumer, the CEO of block.one; Hugh Madden, Director of Technology, OpenANX Foundation, another HK company, which has announced over USD$18m of ‘token sales’; and Dr. Kai Lung-Hui, Professor and Cryptocurrency Expert at HK University of Science and Technology. Moderated by Paul Schulte (founder of Schulte Research), the panel also featured a guest from the Venture Capital industry, Jehan Chu, who invests in blockchain companies and launches cryptocurrency funds. The panel engaged in a two-way dialogue with the audience members, and this blog post highlights some of the issues discussed.

In terms of regulation, the SEC report clearly indicated that not all blockchain tokens are securities under U.S. federal securities laws and that each blockchain token needs separate review and analysis.

For example, block.one, which is developing a new blockchain operating system designed to support commercial-scale decentralised applications, is distributing 1 billion EOS ERC-20 compatible tokens to purchasers on the Ethereum blockchain, which tokens, Blumer notes, do not have any investment interests, are not designed for investment or speculative purposes, and were not designed or should be considered as a type of investment. Certain other tokens, by contrast, may grant to investors investment interests like dividend or profit sharing rights or relate to physical products. There are different variations on these themes too, making any talk of blanket token distribution regulation over-simplified and implausible.

Digital tokens can have any number of attributes. “Tokenisation” can be used as a means of transferring value. Holders of tokens may have voting rights and a say in the way a blockchain is governed. For example, certain token holders may be able to decide whether they want to adopt subsequent iterations of the open source blockchain software upon which the token’s smart contract is based.

Some commentators have predicted that blockchain technology in general would disrupt everything in technology as distributed ledgers ensure that an up-to-date and accurate copy of all transactions on the blockchain are permanently recorded without the need for a centralised entity. Transactions are in a sense made technologically transparent, not just contractually binding.

However, others believe that rather than making certain businesses or industries extinct, companies will attempt to modify their existing processes to adopt blockchain protocols to make their businesses more cost-efficient and forward-looking. This is evidenced by the various consortia of banks, such as those led by R3, who are conducting research and development of blockchain database usage in the financial services industry and co-opting distributed ledgers to reduce costs and improve the services they offer. Blockchain may thus re-shape, rather than eliminate, large financial institutions. Certain sectors of the banking industry, however, such as retail banking, might be more vulnerable. This depends in part on whether industry players adopt a “value-add” or “race to the bottom” approach to delivering financial services.

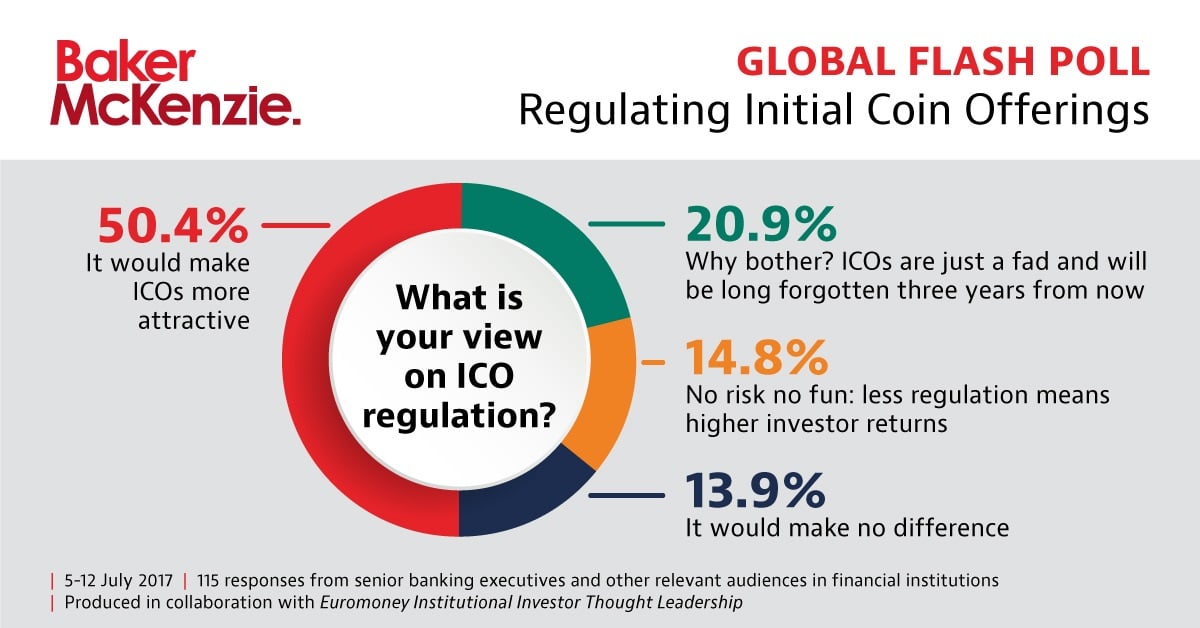

When we asked the panel how they would answer Baker McKenzie’s recent poll on the regulation of token distributions/ICOs and whether it would make them more attractive, the general response was that some form of regulation would be a positive development.

There is speculation that some form of decentralised autonomous organisation regulation would be best because cryptocurrencies represent a globalized value flow based on communities that span the world, rather than nation states. The question of how token distributions should be regulated provokes complex issues, including how regulation could be backed by enforcement in the digital world of distributed ledgers. How is a physical asset secured when based on a smart contract? Can decentralized governance be more effective than centralized governance, with all users of a particular platform signing up to have dispute resolution governed by an international arbitration forum? Would large holders of tokens be able to negatively affect or control the governance of a blockchain?

There is no single answer to these questions. We take a deeper dive into token distribution regulation in our earlier blog post, “Virtual currencies, coins and tokens as an investment – legal framework and regulation for “ICOs” ”. See also our recent White Paper on Blockchains and Laws, which we published in conjunction with R3.

Finally, an interesting recent trend is that more money is now being raised for blockchain startups through token distributions rather than traditional VC funding. Open ANX prides itself on its recent token distribution, which attracted the most number of individual investors of any token distribution at the time – not just VCs taking the lion’s share of the tokens in order to realise huge gains a year or two hence. As to future trends, members of the panel and audience predicted that there would be a token distribution receiving US$ 1 billion in the next 12 months, that there would be a blue-chip company token distribution in the next three years, and that perhaps Hong Kong or Singapore would become the centre for token sales in Asia.

Watch this space.